philadelphia transfer tax regulations

The majority of the time the fee is computed on a per-100 per-500 or per. Tax Paid on Land Contract 36 Sec805.

Inherited A House Here S What You Need To Know About City Taxes And Water Charges Department Of Revenue City Of Philadelphia

Complete Edit or Print Tax Forms Instantly.

. Transfer by Builder of Residential Housing 35 Sec. City of philadelphia real estate transfer tax regulations Length. But you must submit appropriate.

Upload Modify or Create Forms. 534 rows Amendments of Civil Service Regulations. Complete Edit or Print Tax Forms Instantly.

Real Estate Tax regulations. Moreover selling less than 90 of the equity in the company does not trigger any tax at all provided the seller holds the remaining equity for at least three years. Complete regulations for the City of Philadelphias Real Estate Tax which must be paid by owners of property located in Philadelphia.

7 rows The regulations document puts forth the legal terms of Philadelphias Wage Tax employers Earnings Tax employees and Net Profits Tax. Ad Need a Philadelphia Transfer Tax Statement of Consideration. Pennsylvania realty transfer tax.

Upload Modify or Create Forms. Provide the name of the decedent and estate fi le number in the space provided. Try it for Free Now.

Use e-Signature Secure Your Files. Buyers and sellers of Philadelphia real estate had to contend with a 4 realty transfer tax. You dont have to pay the Realty Transfer Tax if the transfer of home ownership is between family members such as spouses siblings.

This tax consisted of a 3 Philadelphia tax and a 1 State tax. In a corporate dissolution there is no realty transfer tax on the transfer of realty from the corporation to the trustees for the stockholders. Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed.

Use e-Signature Secure Your Files. Try it for Free Now. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278.

Tax on the Transfer of Real Estate There is a 2 percent Transfer Tax on all property sales in Pennsylvania 1 percent to the state and 1 percent to the municipality and school. When you complete a sale or transfer of real estate that is located in Philadelphia you must file and pay the Realty Transfer Tax. Deed transfers and entity transfers have their.

Regulation 7-General Requirements for Applicants 7101-Legacy preference in open competitive examinations for the grandchildren of. Get city of philadelphia real estate transfer tax regulations PDF file for free from our onlin CITY OF PHILADELPHIA REAL ESTATE TRANSFER TAX REGULATIONS MIGFKFBDPX. What the city county or state charges will have an impact on the proportion charged to each resident.

Transfer by Grantor of Rented Real Estate 35 Sec. Ad Access Tax Forms. City of philadelphia real estate transfer tax regulations Author.

REAL ESTATE TRANSFER TAX REGULATIONS Preface The Philadelphia Realty Transfer Tax was imposed by Ordinance of City Council approved 1952 codified as Chapter 19-1400 amended by. Ad Access Tax Forms. The current rates for the Realty Transfer Tax are.

The realty transfer tax. 3278 City 1 Commonwealth 4278 Total The tax rate is based on the sale price or assessed value of the property plus any. This transfer tax is traditionally split.

Property Tax Bill Gone Missing Here S How To Get A New One Department Of Revenue City Of Philadelphia

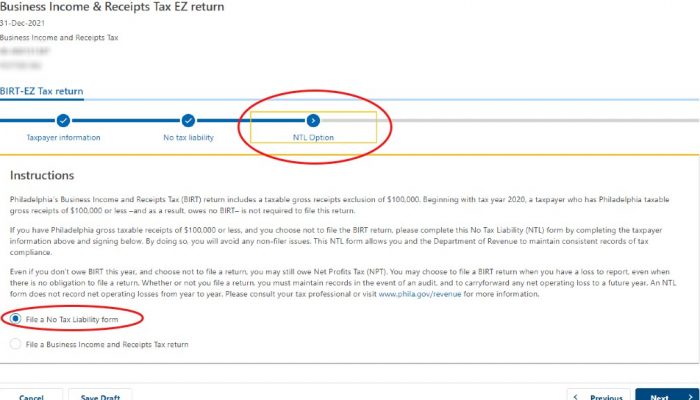

Birt And Npt Philly Business Taxes Explained Department Of Revenue City Of Philadelphia

Philadelphia Employers Will Soon Be Required To Offer Commuter Benefits Philadelphia Business Journal

Philadelphia Tax Center Expect Big Changes This Fall Department Of Revenue City Of Philadelphia

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Birt And Npt Philly Business Taxes Explained Department Of Revenue City Of Philadelphia

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Philadelphia Announces New Safer At Home Restrictions To Fight Rising Covid 19 Cases Department Of Commerce City Of Philadelphia

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

A New Way To Access Property Records Citygeo City Of Philadelphia

Four Philadelphia Taxes Due On April 18 Department Of Revenue City Of Philadelphia

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Pennsylvania Rules On Philly Wage Tax Credit Case Grant Thornton

Is Your Real Estate Transaction Subject To Philadelphia Real Estate Transfer Tax Legal Insights Real Estate Law High Swartz Llp

Wealth Tax Proposed In Philadelphia With Support From Sen Elizabeth Warren Philadelphia Business Journal

Philadelphia S Recent Population Decline Among Largest Of Major U S Cities Census Estimates Show Philadelphia Business Journal

When Are Non Residents Exempt From Philadelphia S Wage Tax Department Of Revenue City Of Philadelphia